Free Promissory Note Templates →

Philippines Promissory Note

✓ Lawyer reviewed — last updated August 2026

Philippines Promissory Note

A Promissory Note, or loan agreement, is used to record that one party promises to pay a sum of money to another party at a later date. This obligation usually results from a loan to the promising party. Creating a Promissory Note or loan agreement is often recommended for tax and record-keeping reasons. This form is also known as: loan agreement, secured loan agreement, demand note.

Answer the questions below to personalize your Promissory Note

Also known as: promisorry note, promissory note form contract template, loan agreement, free iou, i o u, promisory note, promisary note, promissary note, free loan agreement, note form, secured notes, demand notes, demand note agreement, secured note agreement, loan note agreement, installment agreement, loan forms, loan agreement form, iou, i.o.u., contract, document, template

Other Popular Documents

Related External Links

Free Philippines Promissory Note Templates

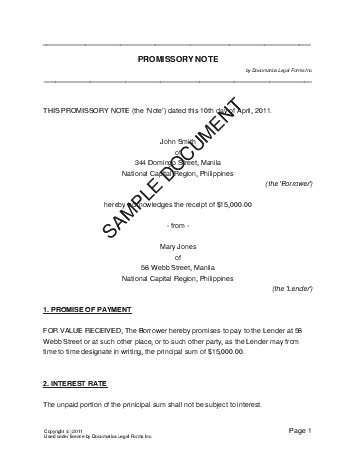

The sample documents below are provided for informational purposes only.

- They are NOT up to date;

- They have NOT been reviewed by a Lawyer;

- They may NOT be legally valid or enforceable.

We strongly recommend obtaining an attorney reviewed Promissory Note directly from us.

Promissory Note

Instructions for free Promissory Note templates:

- Please note that these documents are provided for your informational purposes only:

- They have not been reviewed by a lawyer

- We make no representations as to their quality

- You agree to use them at your own risk

- Select a document above, and cut-and-paste the text into a word processor of your choice.

- Fill in the blanks, modify the wording and format appropriately.

Demand Promissory Note

THE PARTIES TO THIS AGREEMENT ARE:

- Borrower:

- Legal Names:

- Address:

- Lender:

- Legal Names:

- Address:

- For value received, the Borrower hereby unconditionally promises to pay to the Lender the sum of ___________ together with interest accrued at the rate of ________ percent per year on any unpaid balance.

Payable on Demand

- The entire outstanding amount shall become immediately payable upon demand by the Lender providing that such demand not be made before the ______ day of _____________________ 20____.

Place of Payment

- Payment shall be made at the above stated address of the Lender or at such place as may be designated from time to time in writing by the Lender.

Prepayment

- The Borrower may prepay this Note in full or in part at any time without premium or penalty. All prepayments shall first be applied to accrued interest and thereafter to the principal loan amount.

Default

- Should the Borrower not make full payment within 14 days of demand, this Note may be turned over for collection and the Borrower agrees to pay all reasonable legal fees (on a solicitor basis) and out-of-pocket expenses to the extent permissible by law, in addition to the other amounts due.

Transfer

- The Lender may transfer this Note to another holder without notice to the Borrower and the Borrower agrees to remain bound to any subsequent holder of this Note under the terms of this Note.

Joint and Several Liability

- All Borrowers or Co-signors identified in this Note shall be equally liable for the repayment of the debt described in this Note.

Borrower's Waiver

- The Borrower waives presentment for payment, notice of non-payment, off-set, protest and notice of protest and agrees to remain fully bound until this Note is paid in full.

Binding Effect

- The terms of this Note shall be binding upon the Borrower's successors and shall accrue to the benefit and be enforceable by the Lender and his/her successors, legal representatives and assigns.

Jurisdiction

- This Note shall be construed, interpreted and governed in accordance with the laws of _______________ and should any provision of this Note be judged by an appropriate court of law as invalid, it shall not affect any of the remaining provisions whatsoever.

Borrower: ______________________

Witness: ____________________

Lender: ______________________

Witness: ____________________

Acknowledgement

Signature of Notary Public: ______________________

My commission expires: ______________________

Installment Promissory Note

PARTIES:

- BORROWER:

- Legal Names:

- Address:

- LENDER

- Legal Names:

- Address:

- For value received, the Borrower hereby unconditionally promises to pay to the Lender the sum of ____________ together with interest accrued at the rate of ________ percent per year on any unpaid balance.

Payment Terms

- The Borrower will pay ________ payments of $_____ each at monthly intervals on the _____ day of each month, starting on the _______ day of _________________20____ until the Principal amount and accrued interest is paid in full.

- Payments received shall:

- first be applied to any outstanding late fees;

- then to interest;

- and finally to the Principal.

Prepayment

- The Borrower may prepay this Note in full or in part at any time without premium or penalty.

- All prepayments shall:

- first be applied to any outstanding late fees;

- then to accrued interest;

- and finally to the Principal.

Place of Payment

- Payment shall be made to the above address of the Lender or at such place as may be designated from time to time in writing by the Lender.

Late Payment Fees

- If payment is not made within 7 days as stipulated in the payment terms, the Borrower shall be required to pay an additional late fee in the amount of $______.

Default and Acceleration of Debt

- If the Borrower fails to make any payment when due and the Lender provides notice of such failure, the Borrower must effect payment of the amount due within ____ days, failing which the Lender can demand immediate payment of the entire outstanding Principal amount, accrued interest and late fees.

Collection Fees

- In the event of default this Note may be turned over for collection and the Borrower agrees to pay all reasonable legal fees (on a solicitor basis), collection other charges to the extent permissible by law, in addition to other amounts due.

Transfer

- The Lender may transfer or assign this Note to another holder without notice to the Borrower and the Borrower agrees to remain bound to any subsequent holder of this Note under same terms.

Joint and Several Liability

- All Borrowers identified in this Note shall be jointly and severally liable for the repayment of the debt.

Borrower's Waiver

- The Borrower waives demand and presentment for payment, notice of non-payment, off-set, protest and notice of protest and agrees to remain fully bound until this Note is paid in full.

Binding Effect

- The terms of this Note shall be binding upon the Borrower's successors and shall accrue to the benefit and be enforceable by the Lender and his/her successors, legal representatives and assigns.

Jurisdiction

- This Note shall be construed, interpreted and governed in accordance with the laws of _______________ and should any provision of this Note be judged by an appropriate court of law as invalid, it shall not affect any of the remaining provisions whatsoever.

BORROWER: ______________________________

WITNESS: ___________________________

LENDER: _______________________________

WITNESS: ___________________________

For maximum legal protection, obtain a lawyer reviewed Promissory Note directly from us.